Revolut Singapore pushing ahead with aggressive plans to cater to more users, says its chief

(Photo credit: Revolut)

Source: The Straits Times

Revolut Singapore’s chief is gearing up to expand beyond the fintech firm’s current offerings of remittances, payments and investments, as he pushes on with his mission to simplify people’s financial lives here.

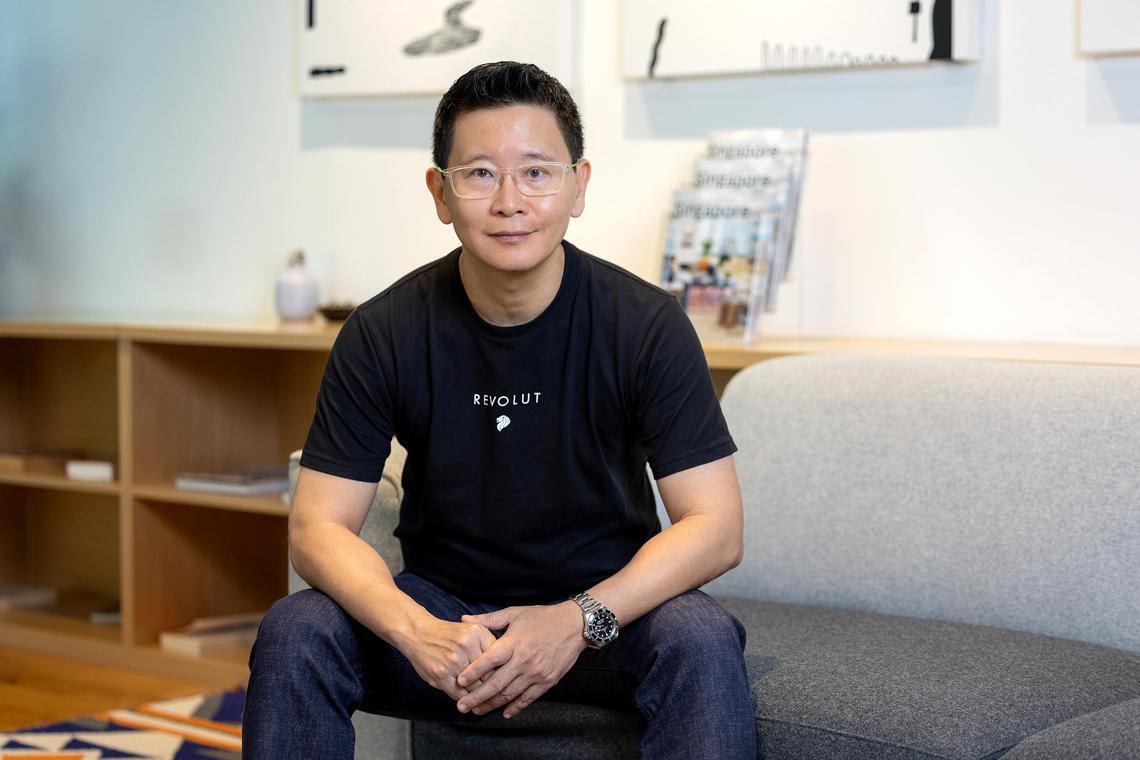

Chief executive Raymond Ng, who took over the reins 2½ years ago, has a series of ideas in the pipeline that include partnering with Alipay so that transfers to China become easier, as well as the addition of five more currencies to its list so people can transact in them.

For businesses, the firm plans to introduce more features to its platform with a focus on savings and investment products, as well as merchant solutions so firms can accept card payments online, directly into their accounts.

The British financial group is also looking to attract the wealthy segment and is toying with the idea of credit products.

The timeline of his plans is not known yet but Mr Ng, 57, told The Straits Times in an interview that the goal is to let every individual and business in Singapore “do all things money” in a few taps, including spending, saving, investing and even borrowing. It is why the firm launched on average a new product or service every 1½ months in Singapore in 2024.

In August 2024, it beefed up benefits for some users here, and introduced in January its own robo-adviser service.

“We have also increased our headcount by close to 50 per cent in 2024 and are continuing the momentum for 2025,” he said.

Mr Ng said the company has set its sights on a banking licence so it can offer more services to customers, such as a savings account or credit products like car loans and mortgages.

When ST pointed out that it is chaotic to be everything to everyone, Mr Ng said having more services is good for the group as it has a huge advantage in economies of scale.

This means the firm is able to replicate products, systems and protocols that work in its key markets to others, he said.

Its economies of scale and the resulting lower costs compared with those trying to start a digital bank from scratch mean “they will take many more years than we do to learn how to be profitable”.

“We already know how to be profitable, even without a savings product or a loan product. But if I have these products, that’ll be even better because I have more services for customers,” he added.

In July 2024, the group announced a net profit of US$428 million (S$577.5 million) for financial year 2023, a stunning rise from US$7 million in FY2022.

In line with that, global revenue almost doubled to US$2.2 billion.

In Singapore, the firm’s annual revenue jumped almost 70 per cent year on year in 2024, led by its card payments business, followed by the foreign exchange and paid plans segments.

About half, or 45 per cent, of the number of card transactions made in 2024 were done domestically.

Revenue from subscriptions or paid plans went up by more than 50 per cent, which, the firm said, shows that customers will pay for value-added services.

Its wealth and trading customers in 2024 more than doubled from a year ago, while the number of under-18 users here grew by close to 80 per cent.

Of its clients, those aged 25 to 34 make up the largest group or nearly 35 per cent of all users, while the take-up rate rose the most with next-generation users aged 18 to 24.

More than one in four of the firm’s customers here are expats.

“The number of expats grew by over 50 per cent in 2024 compared with the year before. We are seeing higher proportions of people using the product internationally in their home country, and then using it in Singapore,” the firm said.

Revolut’s business model is one that relies on a mixture of having volume and higher margin products.

In addition, its mobile-first platform means consumers benefit from lower fees as a result of reduced labour costs, which would typically be higher with physical set-ups.

The firm also adjusts its offerings in efforts to retain customer loyalty, such as lowering fees for standard and premium users who send money abroad in a currency that is local to the recipient country.

But amid the rosy picture, frauds and scams, typically to do with investments or purchases, remain a threat to Revolut’s business.

Mr Ng said the group constantly builds on existing protections. He said the firm rolled out wealth protection in 2024, in the form of a new biometric identification feature designed to prevent thieves from accessing customer savings within the Revolut app.

There is a detection feature that protects customers against card scams using artificial intelligence.

“We also benefit from our global scale, which means if we identify a certain type of scam or fraud in any of our markets, we can immediately implement controls across all markets to prevent something similar from happening again,” he said.

The group’s financial crime prevention team now makes up more than a third of its total global workforce of over 10,000.

Moving ahead, Mr Ng said the outlook for the region is “incredibly promising”, adding that Singapore plays a pivotal role as a gateway to regional expansion.

“With South-east Asia’s rapidly growing digital economy, we see vast opportunities to drive innovation, expand our reach, and build a safer, smarter and more inclusive financial future,” he said.