Singapore downgrades 2025 GDP forecast to 0%-2% as US-China tariff war weighs on global growth

(Photo credit: ST File)

Source: The Straits Times

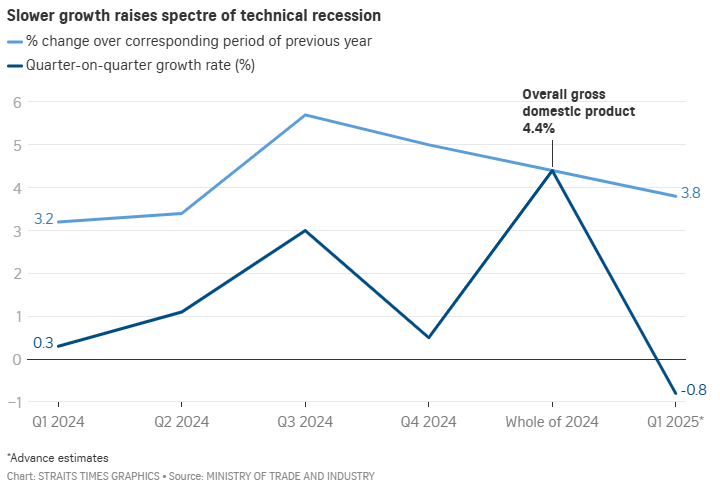

The Ministry of Trade and Industry (MTI) has cut Singapore’s growth forecast for 2025 to zero per cent to 2 per cent in the face of a US-China tariff war, with some economists warning of a possible technical recession in 2025.

MTI’s new forecast announced on April 14 is a downgrade from the 1 per cent to 3 per cent range previously. Singapore’s economy grew 4.4 per cent in 2024.

On the same day, the Monetary Authority of Singapore further reduced the pace of the local currency’s trade-weighted appreciation, in response to easing inflation and rising risks to economic growth.

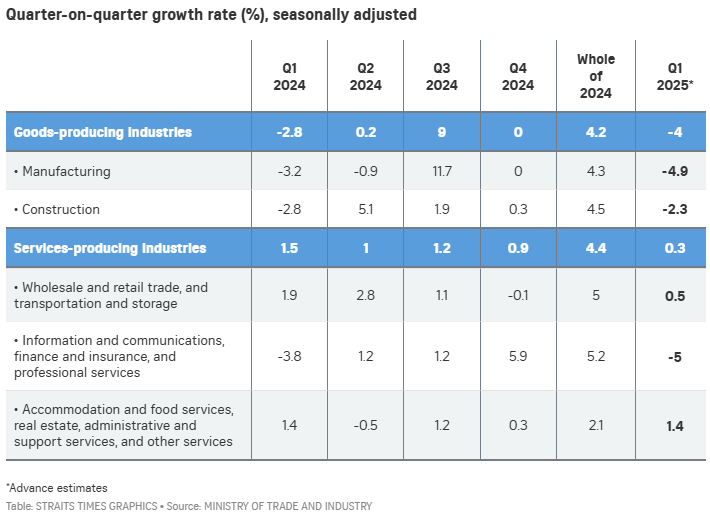

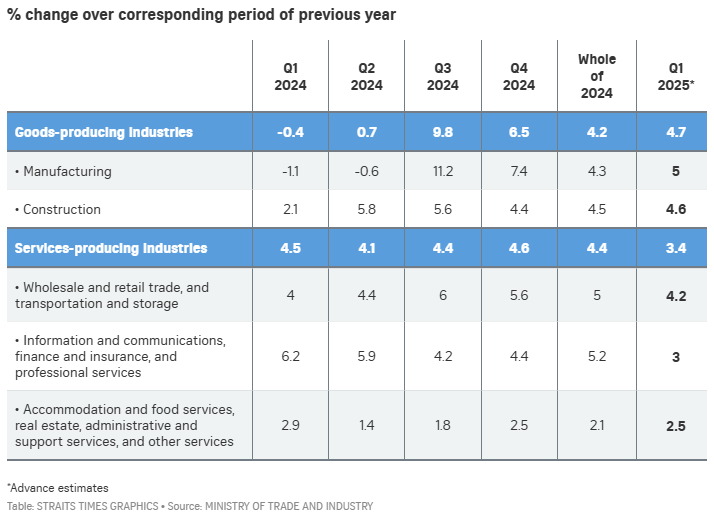

MTI also said Singapore’s economy grew 3.8 per cent year on year in the first quarter of 2025, in advance estimates. This is slower than the 5 per cent growth in the fourth quarter of 2024 and some market projections.

On a quarter-on-quarter seasonally adjusted basis, the economy contracted 0.8 per cent, a reversal from the 0.5 per cent expansion in the fourth quarter of 2024.

Analysts polled by Bloomberg expected 4.5 per cent year-on-year growth and a 0.4 per cent quarter-on-quarter contraction.

MTI said it will continue to closely monitor global and domestic developments, and make further adjustments to its new forecast if necessary.

In a ministerial statement on US tariffs on April 8, Prime Minister and Minister for Finance Lawrence Wong said Singapore may or may not go into recession in 2025, but its growth will be significantly impacted.

On April 9, US President Donald Trump announced a 90-day pause on reciprocal tariffs, with the exception of those on China, which are currently a staggering 145 per cent. In retaliation, China raised its tariffs on American goods to 125 per cent – effective from April 12.

Singapore is still subject to the flat duty of 10 per cent that Mr Trump placed on goods arriving from all foreign countries, which took effect on April 5.

The Trump administration later excluded electronics such as smartphones and laptops from the reciprocal tariffs, which means they will not be subject to the 145 per cent rate levied on China.

But hours later, it said instead that they are included in the semiconductor tariffs, which face a separate round of import tax.

MTI warned that the tariff war posed “substantial downside risks” to the global economy. It said the spike in uncertainty may lead to a larger-than-expected pullback in economic activity as businesses and households adopt a “wait-and-see” approach before making spending decisions.

The tit-for-tat tariff moves could lead to a full-blown global trade war, which will upend global supply chains, raise costs and lead to a far sharper global economic slowdown.

There could also be disruptions to the global disinflation process and rising recession risks in both advanced and emerging markets, leading to destabilised capital flows that could trigger latent vulnerabilities in banking and financial systems.

Mr Song Seng Wun, economic adviser at securities firm CGS International, said Singapore faces the risk of a technical recession, “given the many uncertainties surrounding the trajectory of economic growth”.

A technical recession is defined as two consecutive quarters of gross domestic product (GDP) contraction.

“While not ideal, it is a more favourable outcome than a full-year contraction,” Mr Song said.

Ms Selena Ling, chief economist and head of global markets research and strategy at OCBC Bank, said “there is no clear sign of bottoming yet”.

“A technical recession is possible as the brunt of the initial US tariff announcements has wreaked significant havoc on financial markets in April and real economic fallout is anticipated in the coming months,” she said.

For the second half of 2025, Ms Ling said Singapore’s economy is likely to sink further from the high base seen in the second half of 2024, when growth was 5.7 per cent year on year in the third quarter and 5 per cent in the fourth quarter. She said this would bring her full-year 2025 growth forecast closer to 1.6 per cent – assuming that the 10 per cent tariff on Singapore remains intact.

Maybank economist Brian Lee is maintaining his 2025 GDP growth forecast at 2.1 per cent, which is slightly above MTI’s new range.

“We are pencilling in a growth slowdown, but not a recession at this stage,” he said.

The US tariff suspension on most countries as well as the diversion of trade and financial flows could cushion the blow to Singapore’s economy, he said.

Domestically, falling interest rates, a construction boom and more fiscal support will also help support growth, Mr Lee said.

He also noted that growth in the manufacturing sector was firmer than expected at 5 per cent in the first quarter of 2025, though moderating from the 7.4 per cent expansion in the fourth quarter of 2024.

This points to front-loading of activity in March amid a race to manufacture and ship out orders ahead of the US reciprocal tariff announcement on April 2.

MTI figures show the construction sector expanded by 4.6 per cent, extending the 4.4 per cent growth in the previous quarter.

Among the services sectors, the wholesale and retail trade as well as transportation and storage sectors collectively grew 4.2 per cent, easing from the 5.6 per cent growth in the previous quarter.

All sectors within the group, except for retail trade, expanded during the quarter.

Growth in the information and communications, finance and insurance, and professional services sectors moderated to 3 per cent.

Singapore’s finance and insurance sector expanded, underpinned by the strong performance of banking and activities related to mostly payments firms.

Growth of the rest of the services sectors, including accommodation and food services, real estate, and administrative and support services, was unchanged from the preceding quarter, at 2.5 per cent.