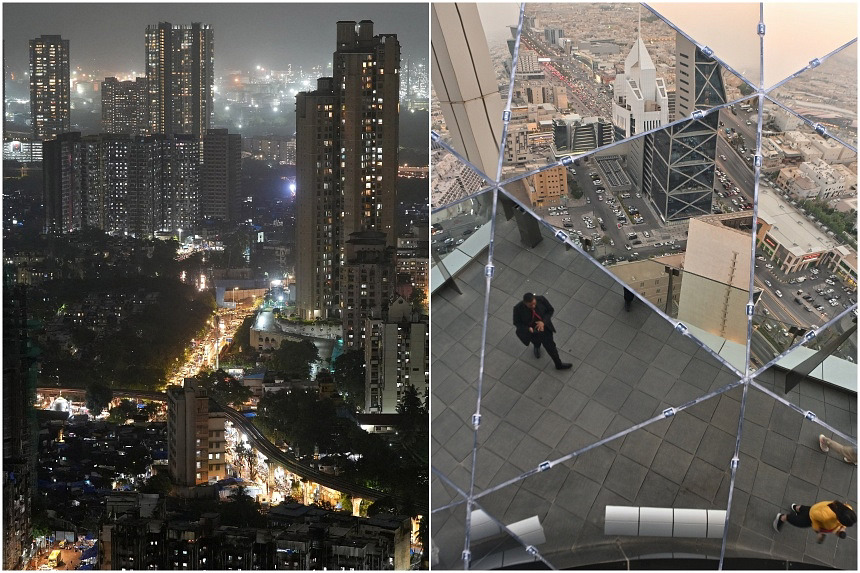

Singapore firms eye under-tapped India and Middle East markets for overseas expansion

(Photo credit: Reuters)

Source: The Straits Times

As multinational corporations rush to diversify their international trade and investment exposure, Singapore companies planning to expand abroad are also increasingly looking at the burgeoning opportunities beyond Asean and China.

In response, the Singapore Business Federation (SBF) and HSBC have joined hands to support local businesses’ expansion overseas in key trade corridors, especially in under-tapped markets including India and the Middle East.

The idea is that companies here should cash in on Singapore’s long history of strong trade and diplomatic ties with India and countries in the Middle East before the first-mover advantage dries up.

Apart from the shifting supply chains and investment flows in response to geopolitical tensions and superpower rivalry in trade and technology, India and the Middle East represent a near-contiguous expanse of some of the world’s fastest-growing economies.

Representing about a quarter of the world’s population, India and the Middle East are also in the midst of an unprecedented drive to boost investment in urban development, transport, utilities, renewable energy, tourism, real estate, manufacturing and logistics.

Some of Singapore’s large enterprises have already moved in. But smaller companies, even if they have an attractive product to offer and have a good business plan, need help.

This was one of the salient points made during an interview with SBF chief executive officer Kok Ping Soon and HSBC Singapore CEO Wong Kee Joo.

Saudi Arabia, for example, plans to spend up to US$175 billion (S$228 billion) a year between 2025 and 2028 on greenfield industrial plants and giga-projects such as Neom, a megacity being built in a bay in the kingdom.

In real estate, it plans to build 660,000 new homes, 289,000 hotel rooms, 6 million sq m of office space and 5.3 million sq m of retail space.

“But Saudi Arabia is not exactly the easiest market for any company,” said Mr Kok, adding that India and most Middle Eastern economies are not as open as Singapore.

Saudi Arabia, under Crown Prince Mohammed bin Salman’s Vision 2030 – aimed at diversifying the economy away from oil, has taken many measures to foster a favourable business environment by streamlining and simplifying regulatory processes.

But at times, it can be difficult to navigate the complexities of some of the rules.

For instance, some 400 foreign companies have relocated their regional headquarters to the kingdom since 2021 when the Saudi government declared that it would stop working with international companies without a regional HQ there by 2024.

Mr Kok led a delegation of 32 high-level business representatives from 27 Singapore companies in the energy and sustainability, built environment, marine and offshore, healthcare, and technology sectors to Saudi Arabia and the United Arab Emirates, in conjunction with then Prime Minister Lee Hsien Loong’s official visit in October 2023.

During the visit, SBF signed separate memorandums of understanding (MOUs) with the Ministry of Investment Saudi Arabia and the Federation of Saudi Chambers to deepen the bilateral relationship between the two countries and promote economic cooperation, trade and investment.

In line with the MOUs, the launch of a joint Saudi-Singapore Business Council was announced in September 2023.