Singapore key exports surprise with 13% rebound in June but tariff risks weigh on outlook

(Photo credit: ST File)

Source: The Straits Times

Singapore’s key exports enjoyed a surprisingly strong rebound in June, reversing their fall in May, as businesses likely front-loaded orders ahead of threatened US tariff increases.

Despite June’s outperformance, analysts said the trade outlook remains murky, depending on eventual tariff rates that Singapore and its trading partners will face from the US.

US President Donald Trump’s tariff pause deadline was extended from July 9 to Aug 1, but continues to darken the trade outlook for Singapore, which is currently subject to a 10 per cent baseline duty.

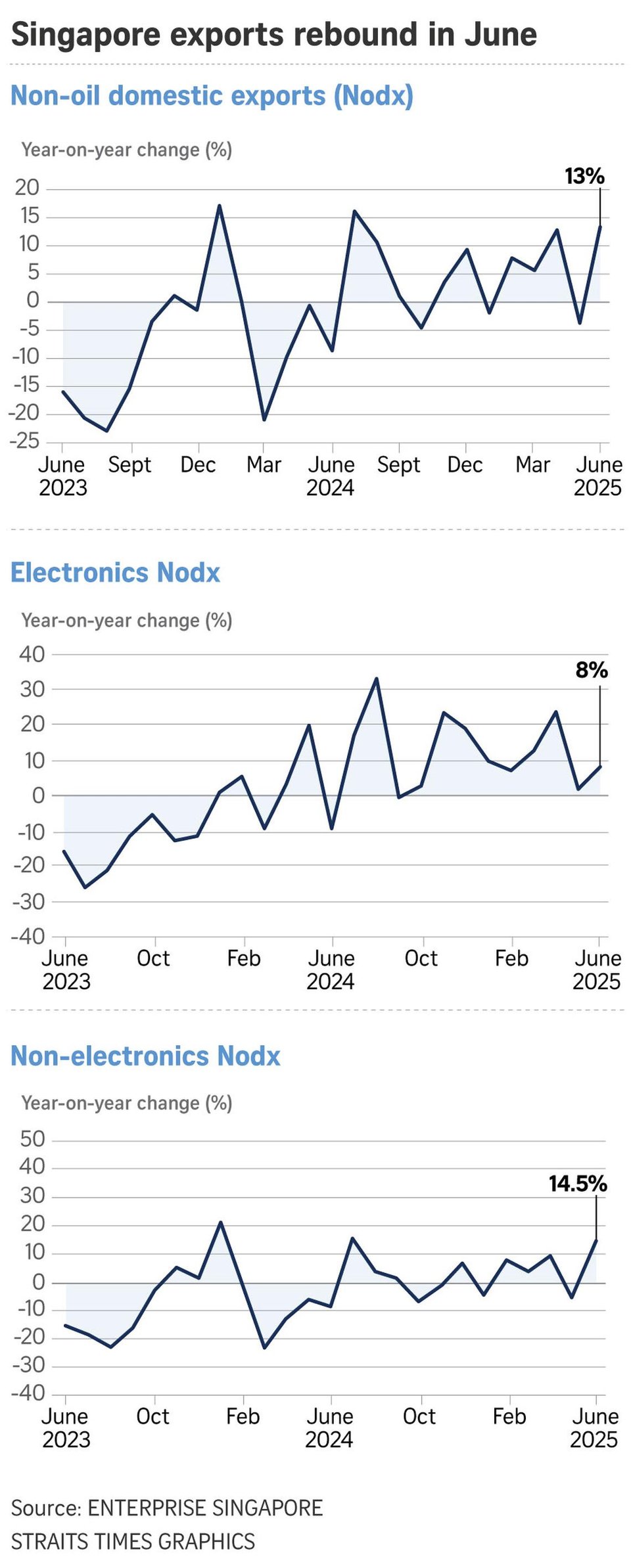

Non-oil domestic exports (Nodx) expanded 13 per cent in June from a year ago, after a revised 3.9 per cent decline in the previous month, data from Enterprise Singapore (EnterpriseSG) on July 17 showed.

This beat the expectations of analysts polled by Reuters, who forecast a rise of 5 per cent.

For the first six months of 2025, exports rose 5.2 per cent.

EnterpriseSG said it is actively monitoring the evolving tariff situation and will adjust its 2025 forecast for key exports as necessary to reflect changing market conditions.

The next forecast will be released in August, it added.

The agency had said in its May quarterly trade review that it expects growth in key exports to come in at the lower end of its 1 per cent to 3 per cent forecast for 2025.

Mr Trump, who has sent more than 20 letters to trading partners outlining the tariff rates for different countries, has yet to send a letter to Singapore.

The US is Singapore’s second-largest export market, accounting for 11 per cent of the Republic’s domestic exports in 2024. But besides the direct impact of US tariffs, Singapore is also affected by the secondary impact of trade with other tariff-hit countries, including China, its biggest export market.

Analysts said the June rebound is likely due to continued front-loading of orders to beat Mr Trump’s initial July 9 deadline for his reprieve on higher reciprocal tariffs.

“Global electronics demand is rising strongly on broadening artificial intelligence demand and exemptions from reciprocal tariffs, benefiting Singapore’s exports of semiconductors, specialised machinery and other electronic components,” said Maybank analysts Chua Hak Bin and Brian Lee.

But this front-loading can also result in “payback” in the second half of 2025 through decelerating trade and manufacturing production, noted DBS Bank senior economist Chua Han Teng.

In June, shipments of electronic products grew 8 per cent year on year, extending the 1.6 per cent increase in the previous month.

Integrated circuits, or chips, grew 17.5 per cent, while personal computers surged 53.8 per cent and bare printed circuit boards rose 17 per cent. These three segments contributed the most to the increase in electronics shipments.

Non-electronics shipments also expanded in June, by 14.5 per cent, reversing the 5.8 per cent decline in the previous month.

Non-monetary gold exports soared 211.9 per cent, while specialised machinery grew by 31.4 per cent. Other speciality chemicals expanded 20.1 per cent.

In June, shipments to the US dropped, alongside falling shipments to the euro zone, Thailand, Malaysia, Indonesia and Japan.

Maybank’s Dr Chua and Mr Lee said some exports may have been diverted from Europe during the 90-day reprieve, as manufacturing supply cannot be ramped up quickly to meet import demand.

“Exports to Europe will likely recover and catch up after the US reciprocal tariffs become effective in August. This will help offset and cushion any export slowdown to the US in the second half,” they said.

Looking ahead, DBS’ Mr Chua said: “Singapore’s external demand will likely face downward pressures due to still-high global trade frictions and continued uncertainty surrounding US tariffs, such as the potential imposition of US sectoral tariffs on semiconductors and pharmaceutical goods.”

Tariffs on semiconductors and pharmaceuticals will likely hit Singapore hard because of its reliance on these sectors for exports and its role as a global supply chain hub.

Mr Trump this week threatened to impose tariffs on pharmaceutical products and semiconductors as soon as Aug 1.

Ms Selena Ling, OCBC Bank’s chief economist, said her forecast for the second half of 2025 is a fall in key exports of 2 per cent, compared with 2024.

“But there may be some upsides if the tariff deadline is pushed back further or if eventual tariff levels are brought down,” she said.

She also revised the forecast for full-year exports to be 2 per cent growth.

“This is given that the reciprocal tariff implementations have been pushed back from April to August, and ongoing trade deals suggest eventual tariff rates may be lower than initially feared,” she said.

RHB group chief economist Barnabas Gan and associate research analyst Laalitha Raveenthar also upgraded their forecast to 2 per cent in 2025, up from an initial 0 per cent.

“The latest data reaffirms a key trend. Resilience in regional demand continues to be a critical anchor for Singapore’s external sector,” they said. “However, despite the encouraging headline figures, we maintain a measured stance on the broader trade outlook.”