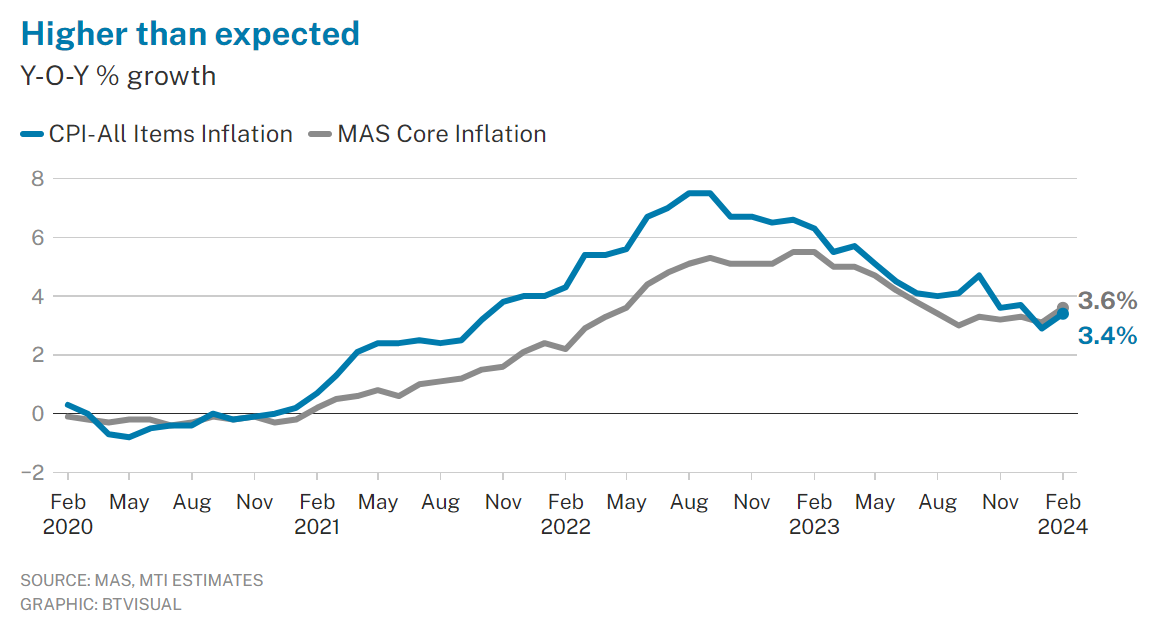

Singapore’s inflation rises more than expected in February; core inflation at 3.6%, headline at 3.4%

Source: The Business Times

SINGAPORE’S inflation heated up more than expected in February, with both headline and core inflation rising at a faster pace than the month before, data from the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) showed on Monday (Mar 25).

Headline inflation for the month rose to 3.4 per cent year on year, higher than the 2.9 per cent recorded in January, as well as the 3.2 per cent median forecast by private-sector economists polled by Bloomberg.

The higher inflation is a reflection of a pickup in accommodation inflation, in addition to higher core prices, said MAS and MTI.

Core inflation, which excludes accommodation and private transport, climbed to 3.6 per cent year on year, accelerating from the 3.1 per cent recorded in the previous month and above economists’ median estimate of 3.4 per cent.

MAS and MTI said this was driven by higher services and food inflation, partly reflecting seasonal effects associated with Chinese New Year.

On a month-on-month basis, headline inflation rose by 1 per cent in February, while core inflation was up by 0.5 per cent.

MAS and MTI kept to their full-year inflation forecasts, with both headline and core inflation expected to average between 2.5 and 3.5 per cent. Excluding the transitory effects of the goods and services tax hike to 9 per cent, headline and core inflation are expected to come in at between 1.5 and 2.5 per cent.

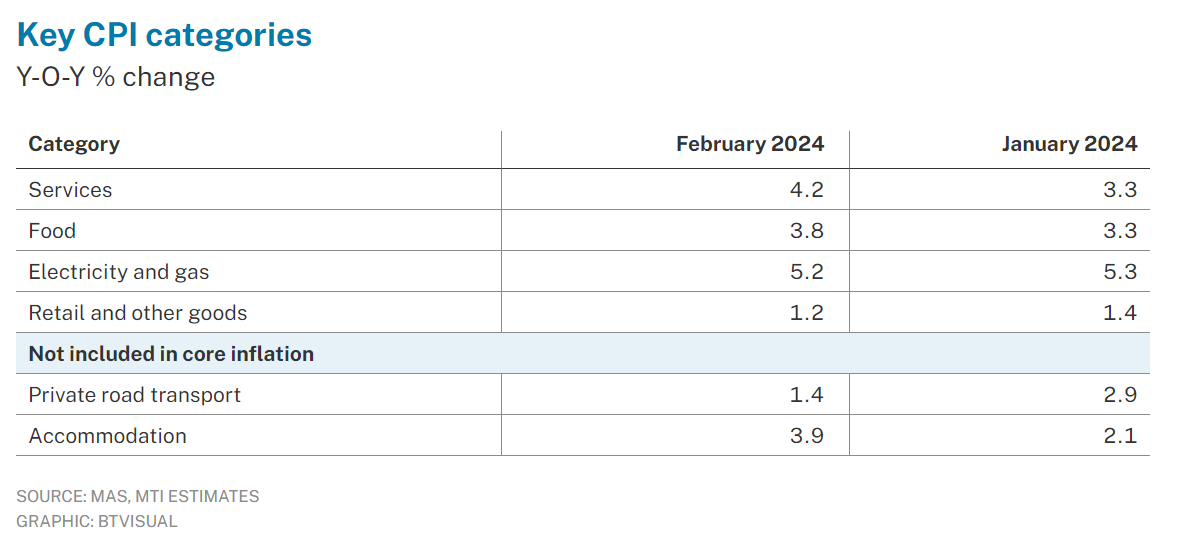

Key consumer price index categories

Accommodation inflation picked up to 3.9 per cent, from the previous month’s 2.1 per cent. This was because additional Service and Conservancy Charges rebates, which were disbursed in January, were not given out in February, said the two authorities.

Services inflation rose to 4.2 per cent year on year, from 3.3 per cent the previous month, mainly due to higher airfares and a steeper increase in holiday expenses.

Food inflation nudged up slightly to 3.8 per cent on the year, from 3.3 per cent in January, as the price of cooked and non-cooked food both rose at a faster pace.

Meanwhile, electricity and gas inflation edged down to 5.2 per cent year on year, from 5.3 per cent previously, due to a slower pace of increase in electricity costs.

Retail and other goods inflation eased to 1.2 per cent, from 1.4 per cent the previous month, as the prices of alcoholic drinks and tobacco increased more modestly.

Private transport inflation fell to 1.4 per cent year on year, from 2.9 per cent before, due to a slower rate of increase in car prices, which in turn reflected lower Certificate of Entitlement premiums.